philadelphia wage tax return

The new wage tax rate for non-residents of Philadelphia who are subject to the Philadelphia municipal wage tax is 35019 percent which is an increase from the previous rate. Additionally individuals who maintain a.

Philadelphia Estate Planning Tax Probate Attorney Law Practice Limited To Business Corporation Law Tax Probate Estate Administration Wills Trusts Amending Tax Returns With The Irs Electronic Filing Now Available For 2019

Beginning on July 1 2021 the City of Philadelphia will lower the rates of its Wage Tax and Earnings Tax for both resident and non-resident taxpayers alike.

. Tax rates penalties fees How much is it. Beginning on July 1 2021 the City of Philadelphia will lower the rates of its Wage Tax and Earnings Tax for both resident and non-resident taxpayers alike. People who meet the criteria can.

All Philadelphia residents owe the Wage Tax regardless of where they work. Electronic funds transfer EFT Modernized e-Filing MeF for City taxes. Philadelphia has the nations highest wage tax currently 387 for residents and 35 for nonresidents who commute to work in the city.

All Philadelphia residents owe the City Wage Tax regardless of where they work. The tax applies to payments that a person receives from an employer in return for work or services. Business Income Receipts Tax Return BIRT Individuals engaged in any for-profit activity within the city of Philadelphia must file a BIRT return.

2021 Business Income Receipts Tax BIRT forms. 20 rows Semi-monthly and weekly filers must submit their remaining 2021 Wage Tax returns and payments electronically through the Philadelphia Tax Center. City of Philadelphia Wage Tax This is a tax on salaries wages and other compensation.

The new rates are as. Starting in 2022 all Wage. The City of Philadelphias Department of Revenue has changed the Philadelphia Wage Tax Return filing requirement to quarterly.

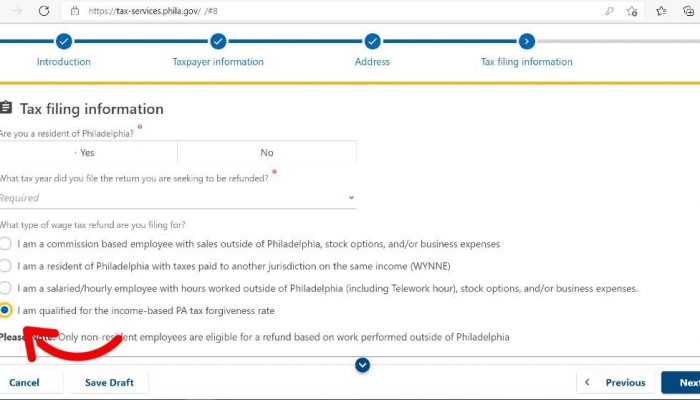

Beginning on July 1 2021 the City of Philadelphia will lower the rates of its Wage Tax and Earnings Tax for both resident and non. The City Wage Tax is a tax on salaries wages commissions and other compensation. 9 rows Wage Tax refund form salaried employees Salaried employees can.

City residents have to pay 38712 and non-residents who work in the city owe. Expenses from 2106 - Enter the unreimbursed employee expenses as supported. 2021 Wage Tax forms These forms help taxpayers file 2021 Wage Tax.

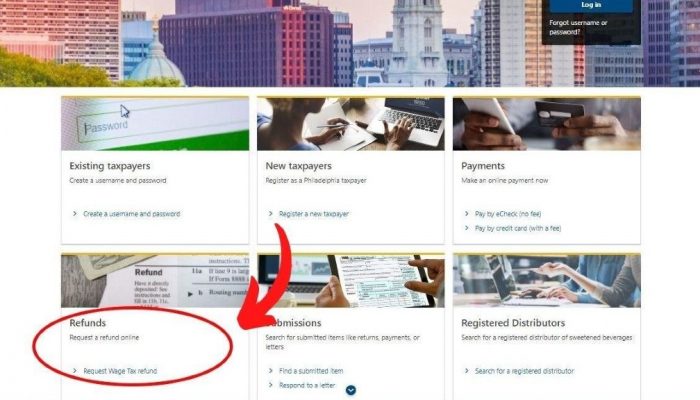

You can also file and pay Wage Tax online. Make an appointment for City taxes or a water bill in person. For more information about these changes please visit the.

Forms documents. The new rates are as. Beginning on July 1 2021 the City of Philadelphia will lower the rates of its Wage Tax and Earnings Tax for both resident and non-resident taxpayers alike.

Sales Earned Outside of Philadelphia - Enter the number of days or hours employed outside Philadelphia. The tax has often been cited as a job. What is the city wage tax in Philadelphia.

See all Tax forms. If youre approved for tax forgiveness under Pennsylvania 40 Schedule SP you may be eligible for an income-based Earnings Tax refund. Non-residents who work in Philadelphia must also pay the Wage Tax.

Philadelphia says A petition for refund of erroneously withheld wage tax from an employee must be made by the employer for and on behalf of the employee Refer to. Because of COVID I will be able to work from. The new rates are as.

2021 Net Profits Tax NPT forms. The first due date to file the Philadelphia Wage. The new rates are as.

2021 School Income Tax forms. You dont need a username and password to make a payment. How to file and pay City taxes.

However you must make electronic payments in the new Tax Center. Effective July 1 2021 38398 Resident 34481 Non-resident Effective July 1 2020 38712 Resident 35019 Non-resident Effective July. Beginning on July 1 2021 the City of Philadelphia will lower the rates of its Wage Tax and Earnings Tax for both resident and non-resident taxpayers alike.

It is customary for me to get a credit on my New Jersey income tax return for the Philadelphia municipal wage taxes I have paid.

There S A New Tax Refund Available In Philadelphia This Year Philadelphia Legal Assistance

Delayed City Wage Tax Refunds Still Being Paid Nbc10 Philadelphia

Irs Experiencing Major Backlog Delays On Tax Refunds 6abc Philadelphia

You Pay Lots Of Philly Taxes But Do You Know Why Philadelphia Magazine

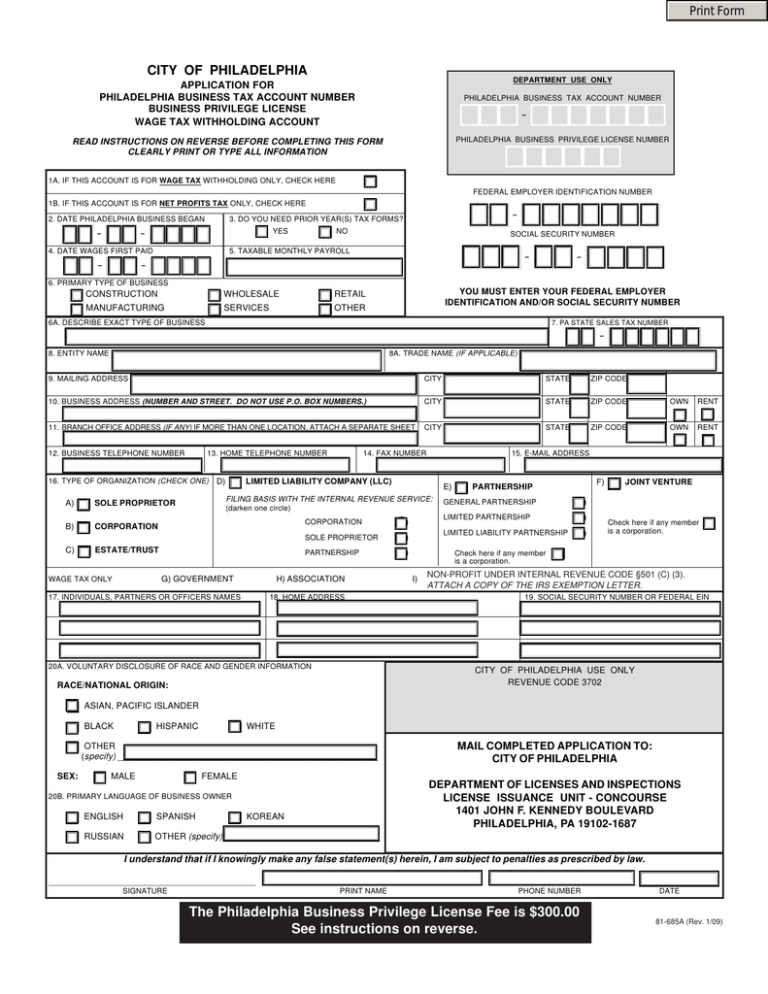

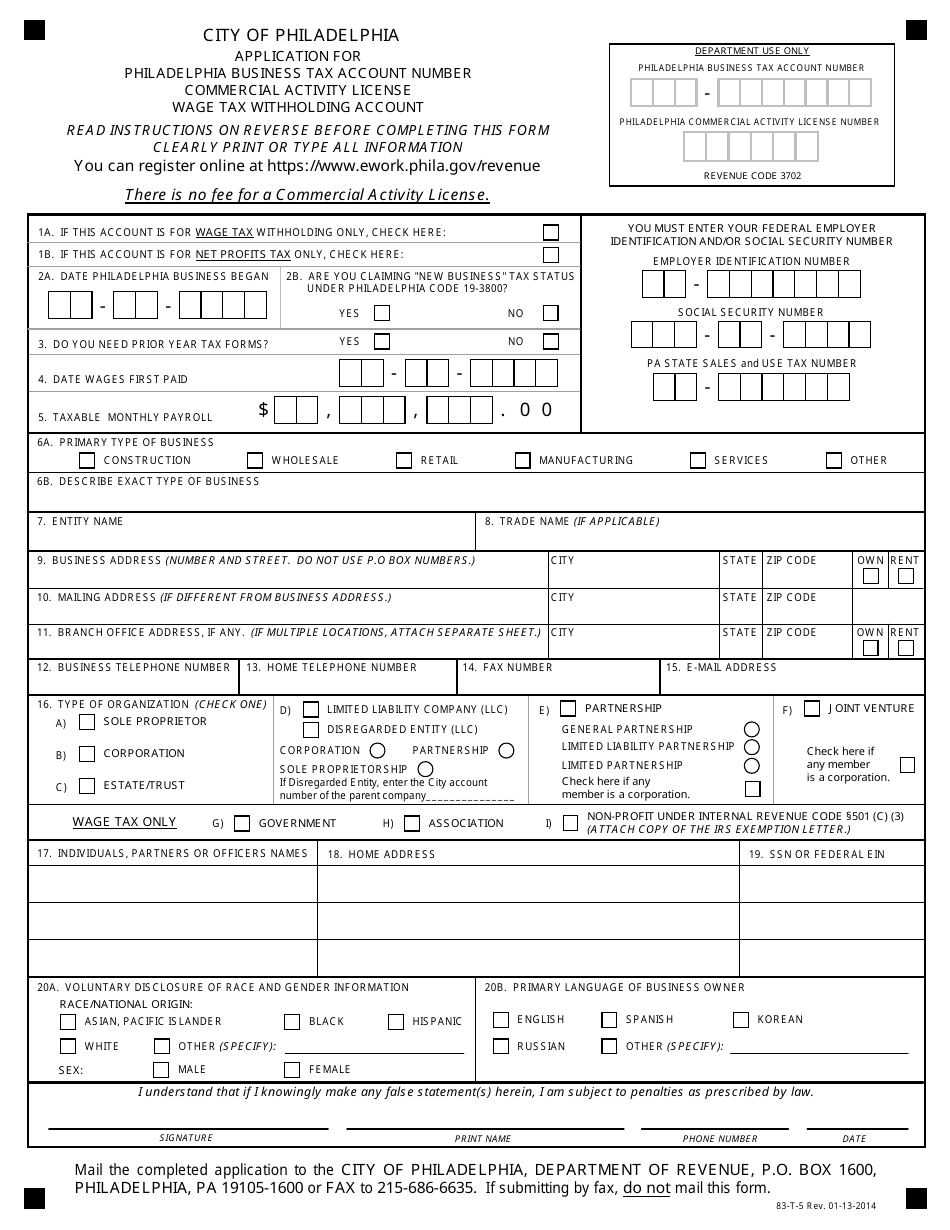

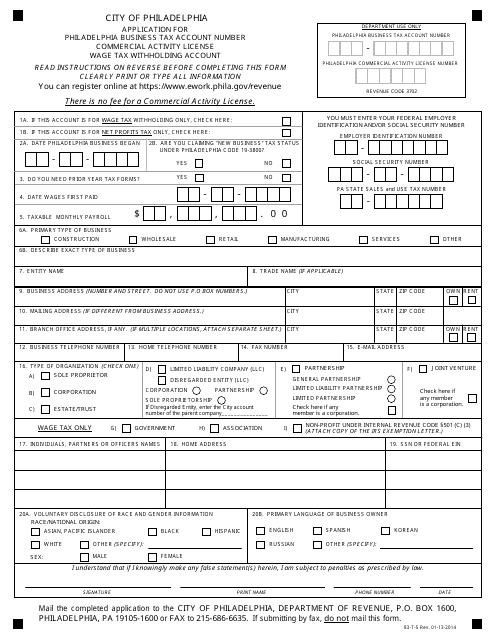

Form 83 T 5 Download Printable Pdf Or Fill Online Application For Philadelphia Business Tax Account Number Commercial Activity License Wage Tax Withholding Account City Of Philadelphia Pennsylvania Templateroller

Philadelphia Wage And Earnings Taxes Decrease On July 1 Department Of Revenue City Of Philadelphia

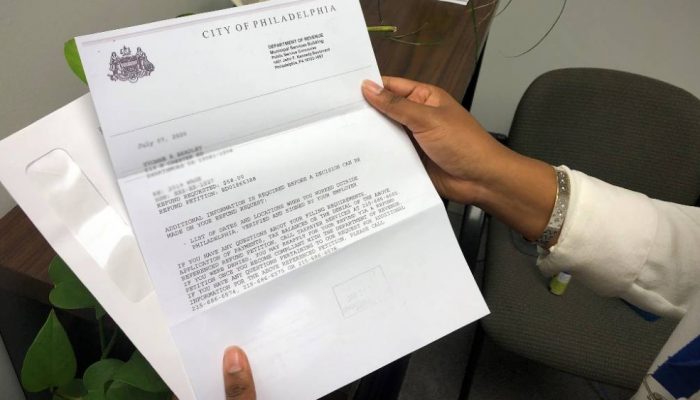

How To Understand A Letter From The Irs Philadelphia Legal Assistance

Form 83 T 5 Download Printable Pdf Or Fill Online Application For Philadelphia Business Tax Account Number Commercial Activity License Wage Tax Withholding Account City Of Philadelphia Pennsylvania Templateroller

Form 83 T 5 Download Printable Pdf Or Fill Online Application For Philadelphia Business Tax Account Number Commercial Activity License Wage Tax Withholding Account City Of Philadelphia Pennsylvania Templateroller

Why Was My Refund Request Denied Answers To Frequent Wage Tax Questions Department Of Revenue City Of Philadelphia

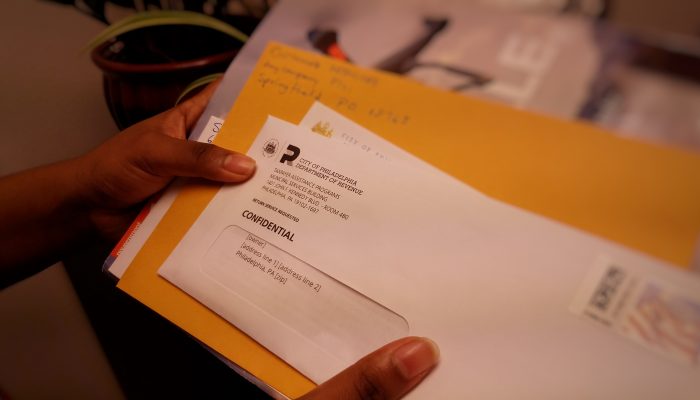

Check The Po Box Mailing Tax Payments Forms To Revenue Department Of Revenue City Of Philadelphia

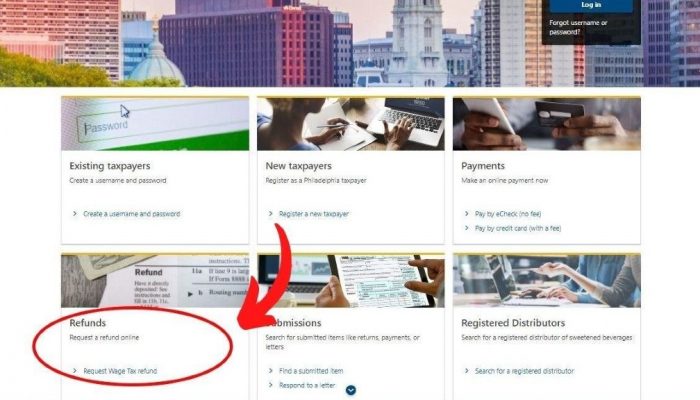

Wage Tax Refunds And Payment Plans Made Easy Department Of Revenue City Of Philadelphia

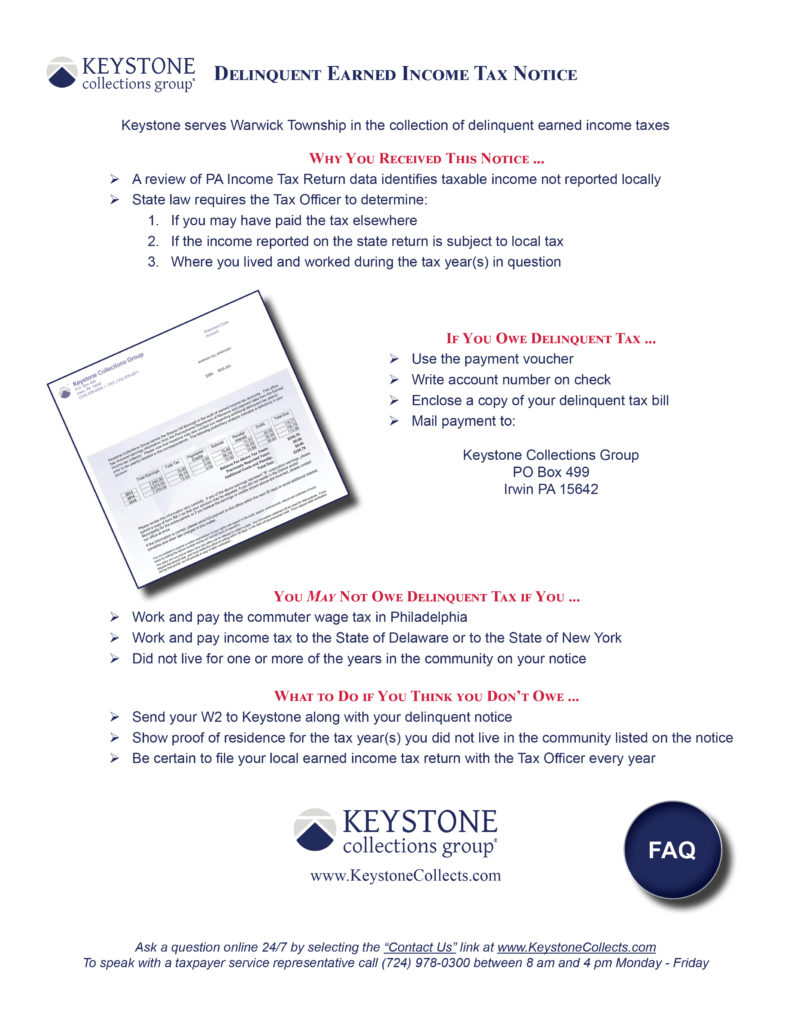

Taxes Warwick Township Bucks County

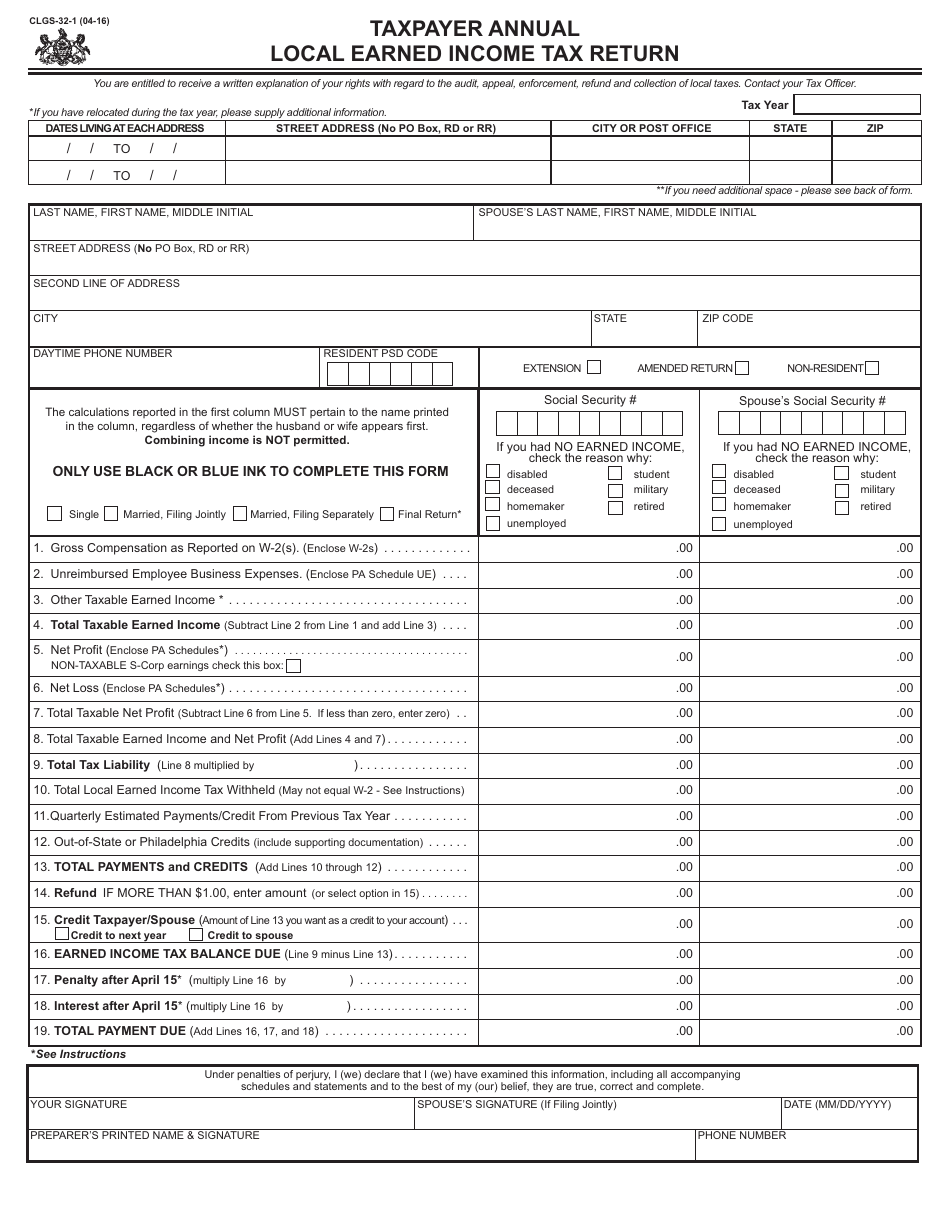

Form Clgs 32 1 Download Fillable Pdf Or Fill Online Taxpayer Annual Local Earned Income Tax Return Pennsylvania Templateroller

Pa Dced Clgs 32 1 2016 2022 Fill Out Tax Template Online Us Legal Forms

Pa Local Earned Income Tax Return Fill Out Tax Template Online Us Legal Forms

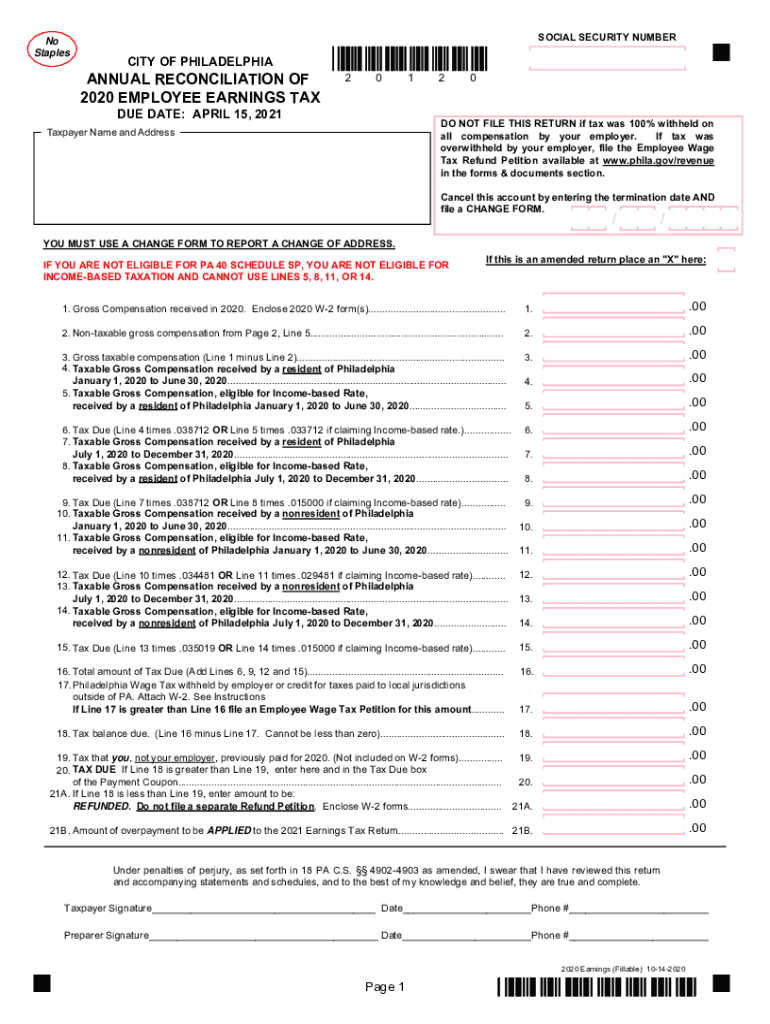

Pa Annual Reconciliation Employee Earnings Tax City Of Philadelphia 2020 2022 Fill Out Tax Template Online Us Legal Forms

Request 2021 Wage Tax Refunds Online Department Of Revenue City Of Philadelphia